Free Tax Return Preparation | VITA (Volunteer Income Tax Assistance)

에덴 VITA ( 무료 세금 보고 서비스 )

|

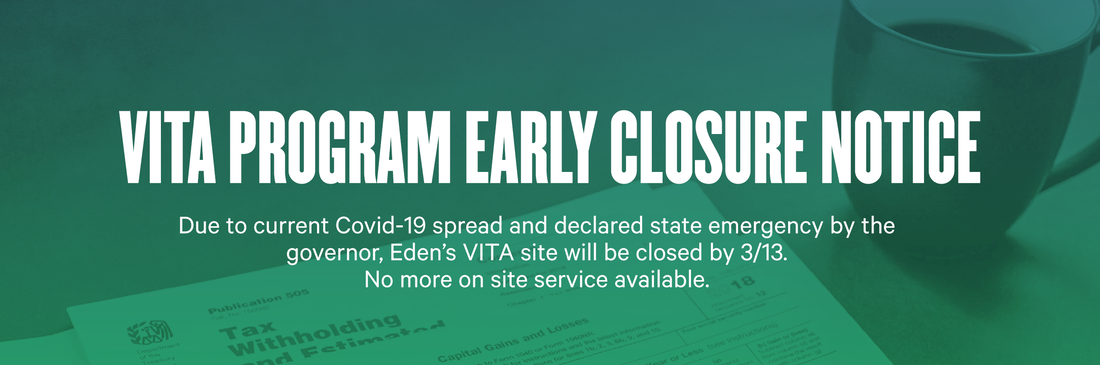

Notice to Taxpayers

To Prevent the Spread of Coronavirus Disease 2019 and for Public Health

Thank you for your patience and cooperation. Eden Presbyterian Church |

|

who’s eligible

Families with income up to $56,000 or Person who are age 60 and older or Person with disabilities when Saturdays, February 15 — April 11 10:30am to 4pm location Eden Presbyterian Church 1200 SW 185th ave, Beaverton 일시 및 장소: 2월 15일 부터 4월 11일 까지 매주 토요일 오전 10시 30분- 오후 4시 구 예배당 친교실 자격 요건: 연 가구소득 $ 56,000 미만인 납세자 또는 60세 이상 시니어나 거동이 불편하신 납세자 또는 세금 보고를 위한 영어 사용에 어려움이 있으신 분. 자원 봉사자 모집: 중·고교생도 지원 가능하며 일정 요건 충족시 IRS의 봉사활동 확인서 발급 가능. 자세한 내용은 교회 게시판 참조 부탁드립니다. |

What to bring

• Proof of identification (photo ID, passport) • Social Security cards (work permit document) • Spouse and children documents (if any) • Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted if you do not have a Social Security Number • Wage and earning statement (Form W-2, W-2G, 1099-R, 1099-Misc) from All Employers • Interest and dividend statements from bank (Form 1099) • Health Insurance exemption certificates, if received • Health Coverage Statement; Forms 1095-A, B & C • Void checks of bank account & routing number for direct deposit • 2018 Federal and State returns (if any) • Proof/receipts of education expenses • Daycare expense information: Total paid to daycare provider, Daycare provider’s tax ID# • For filing jointly: both spouses must be present to sign required forms. |

|

Will Prepare

• Wages, salaries, etc. (Form W-2) • Interest Income (Form 1099-INT) • Dividends Received (Form 1099-DIV) • State Tax Refunds (Form 1099-G) • Unemployment Benefits (Form 1099-G) • IRA Distributions (Form 1099-R) • Pension Income (Forms 1099-R, RRB-1099, CSA-1099) • Social Security Benefits (Form SSA-1099) • Simple Capital Gain/Loss (Form 1099-B) • Sale of Home (Form 1099-S) limited • Self-employed Income (Form 1099-MISC) limited • Gambling Winnings (Form W-2G) • Cancellation of Debt (Form 1099-C) limited • Health Savings Accounts (Form 1099-SA) limited • Itemized Deductions limited • Education Credits (Form 1098-T) • Child Tax Credit • Earned Income Credit • ACA Statements (Forms 1095-A, B or C) • Prior Year and Amended Returns limited |

Will Not Prepare

• Schedule C with losses • Complicated Schedule D (capital gains and losses) • Form SS-5 (request for Social Security Number) • Form 8606 (non-deductible IRA) • Form 8615 (minor’s investment income) • Form SS-8 (determination of worker status for purposes of federal employment taxes and income tax withholding) • Parts 4 & 5 of Form 8962 (Premium Tax Credits) |

Translators Schedules

* Hindi & Arabic Translation for appointment only / drop off (schedule an appointment)

* Hindi & Arabic Translation for appointment only / drop off (schedule an appointment)

Drop us a line at [email protected]

with any questions regarding the program or volunteer opportunities.